‘I more or less fell into it.’

Christoph Loch, former co-owner and co-managing director of ATEK GmbH, says he became an entrepreneur by chance. He never regretted it. A transcript.

Becoming an entrepreneur was not in my life script. I more or less stumbled into it, but after a few years as a non-owner managing director I noticed that I wanted to shape events and work independently, i.e. entrepreneurially. This feeling of self-determination is still the most wonderful professional experience for me today. It is infinitely enjoyable to experience the variety of tasks, to be able to choose them myself and to work on them in my own way.

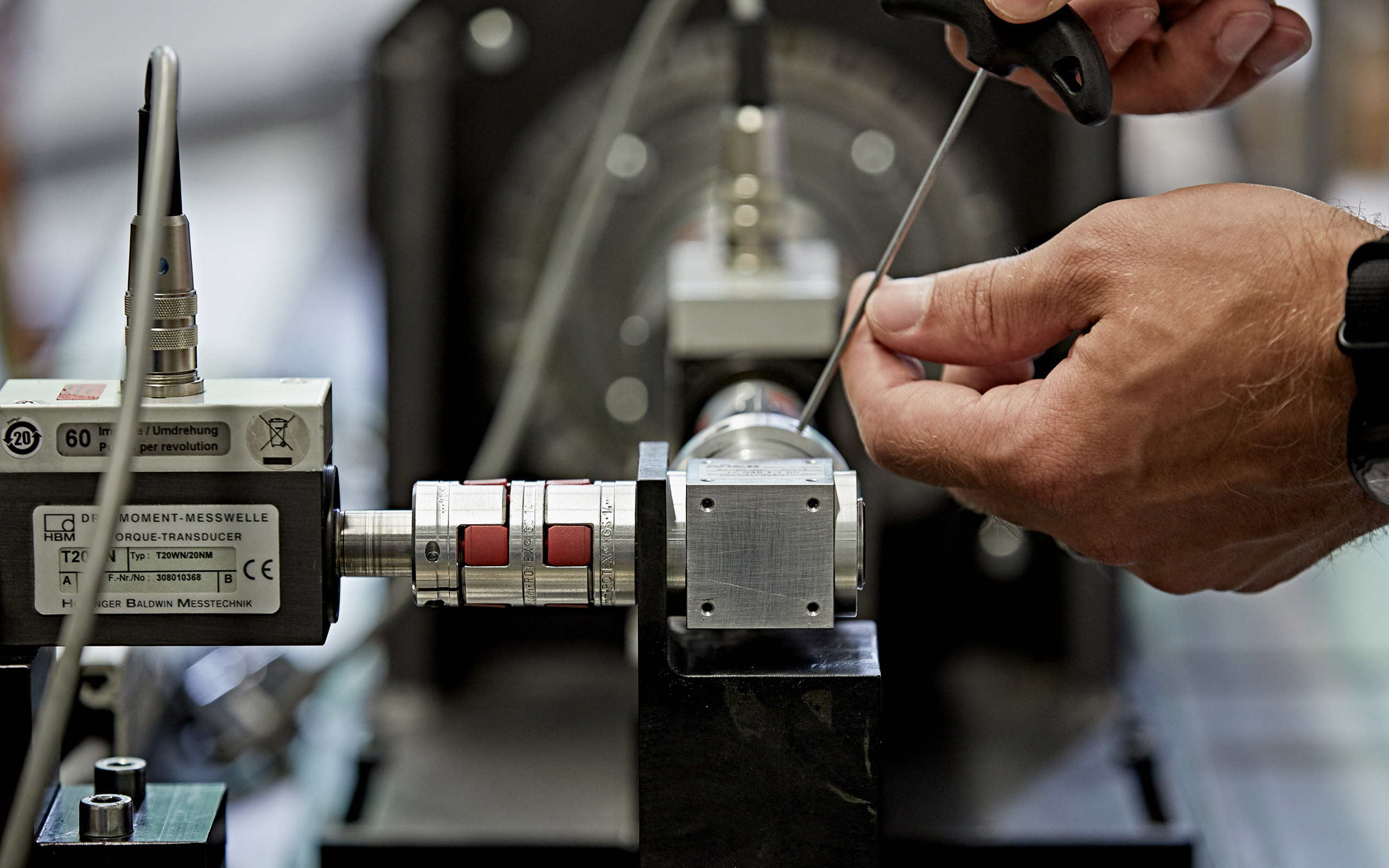

Before joining ATEK GmbH in 2002, I held various positions at Hamburger Sparkasse (a Hamburg-based savings bank) in the private and corporate client business units, personnel development, and strategic branch policy. One of my first tasks at ATEK was to set up a commercial structure that corresponded to the rating requirements introduced for the first time by the lending banks in the wake of the equity capital regulations of Basel II. This structure also had to be able to cushion the expected higher costs for borrowed capital. Back then, I had no expertise in drive technology whatsoever – to be honest, I didn't even know how to build gearboxes at all or exactly what they were used for. My job was to turn these products into a profitable business.

Greatest possible financial independence

In financing our business activities, I always followed the principle that a company should have the greatest possible financial independence. As a very small company, this is generally and ideally achieved by financing investments from cash flow. We established as our guideline a maximum ROI of three years, and thus never accepted the entire financing headroom offered to us by the banks, but only the sums we really needed.

The house banks play an important role for companies the size of ATEK. A decisive plus for us was that the banks understood our business model very well. That's an advantage, especially when negotiating innovative financing models. For example, we converted the usual overdraft facilities into short-term Euribor loans, which we were able to draw flexibly in what at the time were unusually small tranches of 100,000 euros.

Organic growth

Our strategy has always been one of organic growth. There were hardly any attempts to acquire other companies. We had to be very convinced that these acquisitions would really take us forward. In the end, it usually turned out to be more sensible to invest in our own company.

In 2012, the company moved to Rellingen, where ATEK is still based today. We had outgrown the old site, and it was not possible to expand there. The former owners took advantage of the change of location to make a new start in ownership: Axel Brügmann, the second managing director, and I got the opportunity to take over ATEK.

I never regretted my decision to become an entrepreneur. I was always curious, and though I am anything but a technology expert, I always found the product exciting. Above all, I felt the need to shape my working environment. I quickly learned that this willingness to exert a formative influence also requires patience. It is a typical mistake for small and medium-sized companies to want to change everything at once. Our approach has always been to take only one step at a time and to consistently complete every project.

As an entrepreneur, I always rely on teamwork. I am a sportsman, an enthusiastic team player. I believe that many principles can be generalised from sport to corporate management.

Of course, there were also crises, perhaps the most painful in 2009. Suddenly it became clear that there were not only thirty employees whose existence was linked to the company, but also their families. I have to say that it was perhaps one of the happiest moments for me when we emerged intact from this difficult time. The experience of weathering the storm together has brought us all much closer together.

As an entrepreneur, I always rely on teamwork.

What helped us over the years was the freedom that the former shareholders granted us from day one. I know they weren't convinced of every decision we made, but they let us do it. We maintain very close contact with the former owners to this day. I would now like to see this trust placed in the current management. I notice myself that I might have decided differently on some current issues, but the ball is no longer in my court and I trust in the competence of the new management.

Initially, the reason why we decided to sell the company in 2017 was our age. We are at a point as managing directors and owners where we have to ask ourselves what would happen if one of us left the company. We both agreed that it would be difficult for either of us to start fresh with another person, and suddenly we realised that the time had come to think about succession. Our children are still at university, are taking their first career steps outside the industry or are simply too young. Internal solutions for the change of ownership obviously would have required a considerable lead time, if it were possible at all, so the external interest in ATEK was quite opportune.

I see the implementation of the digital transformation as an important issue for my advisory function.

It was important for us to find someone who, like us, sees the potential that still lies dormant in ATEK and who gives us a maximum guarantee that ATEK will find a new home in order to develop further. After more than a year of carefully examining various purchase requests, it was clear to us that these aspirations could not be taken for granted. There were many interested parties, but we also quickly got an idea of how most investors are positioned, often with an extremely short horizon.

Obermark's approach of acquiring companies for good stood out clearly in the circle of interested parties. Obermark was the only interested party that did not pursue an exit strategy. This convinced us, as we did not want to turn ATEK into a trading object. We wanted the employees to have the certainty that their jobs would be secure.

In addition to the long-term strategy, ATEK can also benefit from Obermark in other ways. Within the group, potential synergies may be leveraged, possibly through the joint development of sales structures. With Obermark, we have found a new owner that I didn't even know existed. It is a good feeling to know that ATEK can continue on its successful path in the proven structures. Obermark also took up our proposal for the new managing director. I am grateful for that.

I will remain associated with the company via a consultancy contract until the second managing director has been found. I see the implementation of the digital transformation as an important issue for my advisory function. This is a huge challenge for companies of our size. We cannot allow ourselves any mistakes in digitalisation; we must invest exactly where after careful examination we really see a benefit. The product cycles are also changing at ever shorter intervals for the gears, which can necessitate higher investments – but above all, the effects of action and inaction are becoming clear much more rapidly.

Otherwise, I'm looking forward to a little more time for my hobbies, but I'm not ruling out the possibility that I'll get involved with another company again. The emotional connection to ATEK is very strong. In 17 years, I've experienced a great deal, and that experience is engraved in my heart. So it will certainly be new and unusual for me not to come to work here every day from now on.